How This 28-year-old Increased Her Net Worth By $20,984 in 13 months

This post may contain affiliate links. Please read my disclosure for more info.

In June of 2016, I got my first real job. That meant that for the first time ever I actually had some money to pay my debts. Before that, my strategy was sticking my head in the sand and pretending that the pile of debt didn't exist. I'll be the first to admit that it wasn't exactly the best strategy.

By that time in my life I had moved into my mother's basement where my daughter and I shared a room that only had an inflatable bed and my computer desk - so I was in no place to care about debt payoff strategies.

Flash forward two years later.

I finally landed a job where I'd have enough money coming in to cover my expenses AND pay off my debts.

Like many Americans, I'm now paying for the mistakes I made earlier on in life.

I decided to start reporting my net worth because I know I am not unique in my story. Many of us in our late twenties are paying for the mistakes of our vulnerable and naive teen selves so there's a ton we can learn from each other.

There are three main reasons I'm sharing my money story:

I want you to know that no matter how messed up your situation is, you can get out of debt.

I want to track my own personal net worth over time.

I want to share my unique story in how I'm getting my life together (and one day I will)

Let's get started, shall we?

What is Net Worth?

I was not born (or raised) with a huge understanding of money and what it's meant for (other than buying stuff) so I didn't really understand what net worth meant in practical terms until about two years ago.

Basically its what you own (your cash, investments, home, etc.) minus what you owe (credit card, student loan debt, etc).

What's Included? What's Not?

Tracking net worth can be a bit tricky because people can include (or not include) whatever they want so no two net worth statements will be the same.

What's included here:

Money That Pays My Bills - This is money that comes in... and then goes right back out. It's used to pay rent, phone bill, Netflix and other miscellaneous debts.

Savings Account - I put a small percentage of each paycheck into a savings account.

Investment Accounts - My 401K through my job and a few robo-advisors.

Debts - The only debt I have left is my student loans.

What's not:

Money that's not doing anything productive for my net worth - I have three additional accounts that I put a small percentage of each paycheck into: travel savings, weekly household/grocery spending, and personal fun money. This is money that is meant to be spent on enjoying life now and plays no part in my future plans - so I choose not to include it in my net worth.

Cars - Some people choose to include the value of their car(s) into their net worth statements. There are two main reasons I don't do this: (1) I don't think your car is an asset in by any means (2) don't own a car because it's a money pit (and these days I'm more inclined to keep my money in my pocket).

Homes/Rental Properties - Unlike cars I believe homes/rental properties can be a great way to contribute to your future financial freedom. While I don't have any now, I hope to start adding this to these income reports by 2021.

How Much Money Do I Make?

Now I know it's totally taboo to talk about how much money I make but screw that. I'm going to be 100% open and honest about my income with you because I believe the more we talk about our money stories, the more other people can learn from it.

I can attribute my total money makeover to one person... Wendy.

Wendy is a super badass (and that is literally the only way to describe her.) I met her through an ex-boyfriend and was immediately in awe of her badassity. She went to an ivy league for school, was making $90K+ at some bank, running marathons, had a booming social life AND somehow she was also the treasurer of the Young Dems Chapter. #BadAss

I had no idea how long it took Wendy to accomplish all that, but I knew one thing. When I grew up, I wanted to be Wendy.

At 25 years old, I was making $20K/year, working 3 jobs as a babysitter, waitress and freelancer. (I was so exhausted on a regular basis that I once fell asleep at a full blown rave in the room reserved for people who can't hold their alcohol.)

On top of that, every dollar that came in went right back out. A lot of my friends were struggling so I simply thought that it was normal. I thought that no one really "made money" until they were older. I figured I'd make money one day in my forties after I gained experience, after I'd paid my dues. I was OK with my life.

Then I learned Wendy and I were the same age.

The second I learned that my world shattered. The story I'd told myself to be comfortable with my struggle was no longer true. My age was not the reason I wasn't making money - instead it was my own limited mindset that was holding me back.

From that moment, my mind opened up to the fact that I, too, could get one of those high paying jobs. I went back to school, got a master's in marketing analytics and landed a job as a marketing analyst.

My total annual income now is $69K.

I love telling people how much I make because I know my story can inspire someone the way Wendy inspired me.

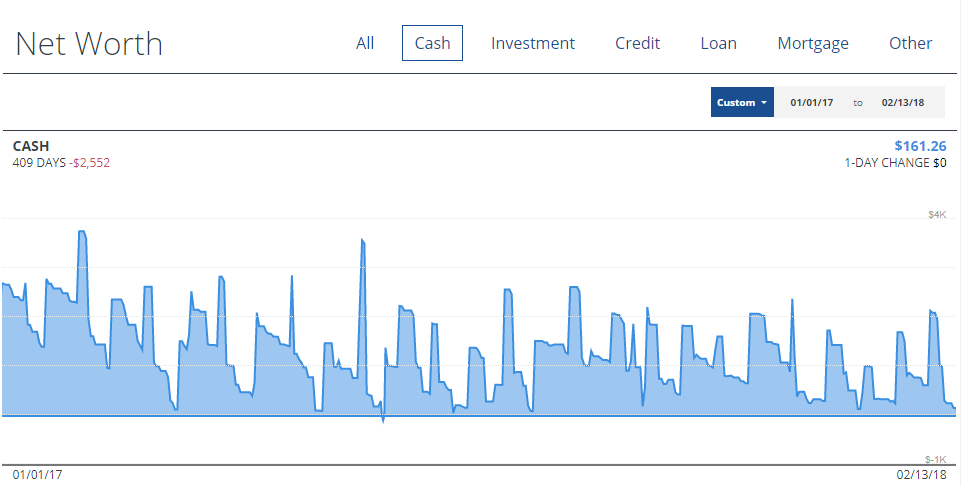

Cash Money

Here's the money that goes into my checking and savings accounts. It fluctuates over time because all the money that goes into my account gets immediately shifted to pay bills and student loans.

My biggest downfall when it comes to my cash money (and why it's impossible for me to keep money in that account) is that I struggle with properly budgeting. Every month, when I inevitably pay too much out (on student loans or elsewhere) I just pull the money out of my savings, dump it into my checking and use it for more bills.

In the future, I plan on moving my emergency savings to a different account to create a barrier between my savings and my checking. However, I don't plan on doing that until after my student loans are paid off. I believe this is the best move for me because the earnings on savings accounts is around .01% (or whatever) while the interest I pay on my student loans is 6% and my credit score is far too low to refinance at a lower rate. That means the most productive place for my money is in paying off these student loans.

Downside (for now) is I don't really have an emergency fund. I'm OK with this because I do have a health savings account and great health insurance to cover me if I have a medical emergency. Also, I do not have a car or own a home so I don't have any physical property to worry about.

Investments

The only investments I have (for now) are the pre-tax retirement account I have through my job and a few robo-advisors investment accounts where I stash some after tax income.

Acorns

Acorns is an investment app that helps you invest tiny amounts of money at a time (so it's perfect for investors on a budget). For every purchase you make, Acorns rounds your purchase amount to the next dollar and invests the change.

My favorite thing about Acorns is if you happen to want to pull your money out of that account for an emergency you totally can! However, it takes about 7 days to get the money back into your account so you're not likely to reach for that money for any immediate need. That's great because it can sit and grow a little at a time.

Betterment

Betterment is another online investment company that helps you invest small amounts of money. I am currently putting $50/month into Betterment and watching what happens over time.

401K

I started to funnel money into my 401K the moment I got my first real job. I was super excited to start putting money towards my retirement. I finally felt like an adult.

I started off putting in 6% of my paycheck (because the company matches at 6%) and I set my account to automatically increase by 3% every year. Right now, I'm up to 12% of my income going into 401K before tax.

Loans

The only debt I'm going to talk about here is my student loans.

Before I started my current job, I had so many debt collectors calling me that I couldn't wait to get rid of them. I had unpaid phone bills, car insurance payments, credit cards that had gone to collections, unpaid medical bills and about $4K that I'm paying back to friends and family that helped keep me afloat when I was at my worst.

I spent the first 6 months at my job paying off all of my small debts and by December 2016 I was ready to start paying off my student loans.

This report starts at the beginning of that journey.

Student Loans

I have a HATE ONLY relationship with my student loans (and I totally have a right to).

Side note: I'm going to hop on my soap box for a second to say what the United States does to students is CRAZY! At the age of 18 when you can't even RENT A CAR you're saddled with tens to hundreds of thousands in student loan debt. If you're a first generation college student like I was then you didn't have anyone to tell you about the important of choosing schools wisely or the impact of student loans on the rest of your life. Instead, you're way too busy celebrating your future success because you think degree=high paying job. #FalseAdvertising

Just for fun, let's take a look at the moment I started to include my student loans into my Net Worth.

You see that GIANT dip right around December 2016?

Yup. That's what student loans will do to you. (Take notes, teens!)

Clearly, I hate my student loans so it shouldn't surprise you one bit that I decided in January 2017 that I'm going to pay off all $42K of my student loan debt in two years.

I've done some pretty interesting things to get there:

I sold my car.

I rented out my second bedroom to my friend's grandfather visiting from Africa.

I (voluntarily) moved out of my apartment to live with my aunt in New Jersey.

I started to look for more opportunities to make money on the site through:

Private workshops and speaking engagements

Book sales

Affiliate marketing (I recently took the Making Sense of Affiliate Marketing course to boost my chops.)

I have paid off $12,913 in student loan debt payments so far.

Going forward, I'm putting a lot more time an energy into creating new products for the blog and performing high at work as well because it's promotion time!!! #WishMeLuck

Any additional income will go towards student loan debt payments.

Net Worth

My total net worth is currently -16,604.93 (reminder: this is including student loan debt).

This is a huge accomplishment I have increased my net worth by $20,984 (about 1/3 of my pretax income) in just 13 months!

The Visuals

My money story is tracked in Personal Capital. That's where I got all of these cool visuals showing where my money is coming in and going out for this post. It's an amazing free website where you can track your net worth, budget and plan for retirement. Sign up for Personal Capital here.

Tracking my net worth is my way of reflecting on my money habits and thinking about different ways to improve them.

What are you doing to improve your net worth?

Want To Start Planning Your Vision Board Party?

Gift yourself our Vision Board Party & Workshop STARTER KIT here. And explore more of our guides, side hustle info and other blog articles at https://thriveloungedc.com.

ABOUT THRIVE LOUNGE

Thrive Lounge is a place to get the motivation to live a purposeful and intentional life that aligns with your values - primarily through vision boards and implementation. Achieve those dreams! We give you the tools to take action. One of our best is the Vision Board Party and Workshop Starter Kit. Click Here to learn more!

We are an international community of like-minded hopers, dreamers, thinkers and DO-ers.

OUR TARGET AUDIENCE -

People that like to lead or provide guidance to others

People that have lots of ideas, but need a little help moving from having thoughts into taking action, and

Future leaders and trainers

In other words… We welcome folks like YOU!

Thank you for visiting!

Thrive Lounge – Click Here to SHOP for training and self-help resources